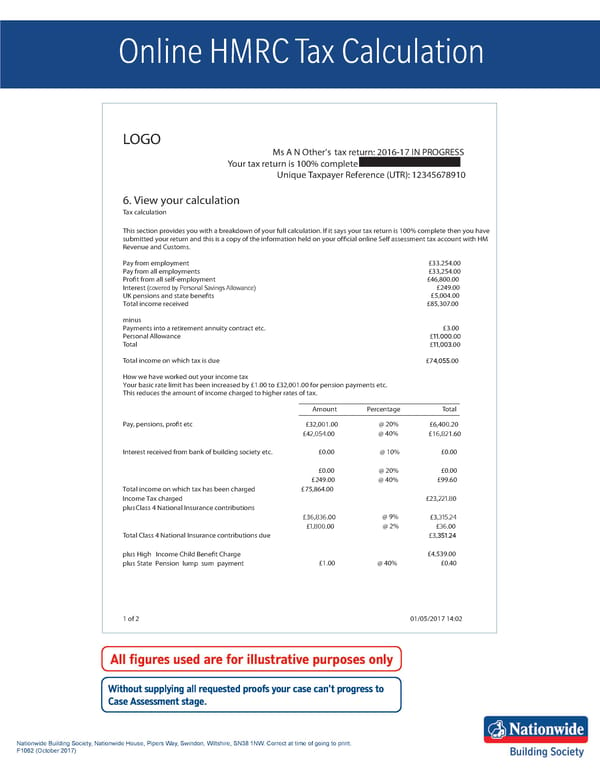

Online HMRC Tax Calculation LOGO 2Ms A N Other’s tax return: 2016-17 IN PROGRESS Your tax return is 100% complete Unique Taxpayer Reference (UTR): 123456789103 6. View your calculation Tax calculation This section provides you with a breakdown of your full calculation. If it says your tax return is 100% complete then you have submitted your return and this is a copy of the information held on your official online Self assessment tax account with HM Revenue and Customs. Pay from employment £33.254.00 Pay from all employments £33,254.00 Profit from all self-employment £46,800.00 Interest (covered by Personal Savings Allowance) £249.00 UK pensions and state benefits £5,004.00 Total income received £85,307.00 minus Payments into a retirement annuity contract etc. £3.00 Personal Allowance £11.000.00 Total £11,003.00 Total income on which tax is due £74,055.00 How we have worked out your income tax Your basic rate limit has been increased by £1.00 to £32,001.00 for pension payments etc. This reduces the amount of income charged to higher rates of tax. _____________________________________________ Amount Percentage Total _____________________________________________ Pay, pensions, profit et c £32,001.00 @ 20% £6,400.20 £42,054.00 @ 40% £16,821.60 Interest received from bank of building societ y etc. £0.00 @ 10% £0.00 £0.00 @ 20% £0.00 £249.00 @ 40% £99.60 Total income on which tax has been char ged £75,864.00 Income Tax char ged £23,221.80 plus Class 4 National Insurance contributions £36,836.00 @ 9% £3,315.24 £1,800.00 @ 2% £36.00 Total Class 4 National Insurance contributions due £3,351.24 plus High Income Child Benefit Charge £4,539.00 plus State Pension lump sum payment £1.00 @ 40% £0.40 6 1 of 2 01/05/2017 14:02 All figures used are for illustrative purposes only All figures used are for illustrative purposes only Without supplying all requested proofs your case can’t progress to Case Assessment stage. Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print. F1062 (2FWREHU 2017)

A guide to our HMRC Tax Calculation & Tax Year Overview requirements Page 1 Page 3

A guide to our HMRC Tax Calculation & Tax Year Overview requirements Page 1 Page 3.png)