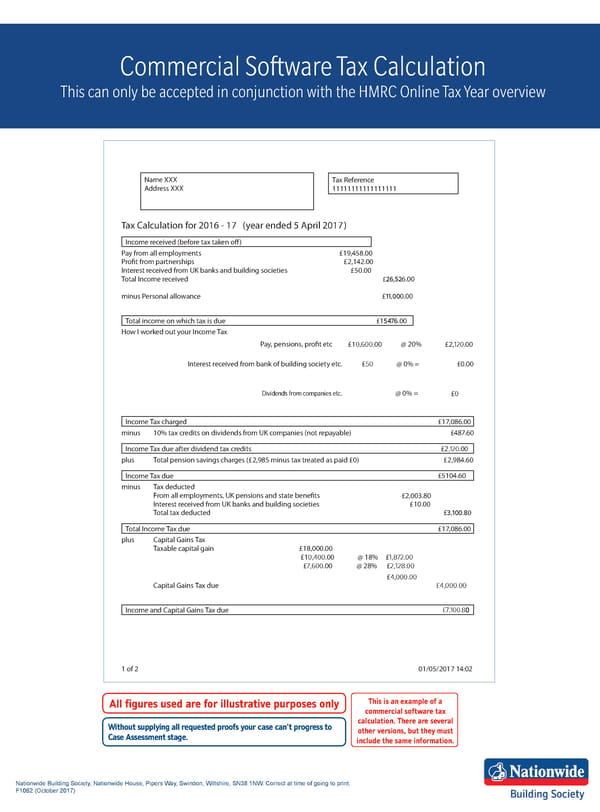

Commercial Software Tax Calculation This can only be accepted in conjunction with the HMRC Online Tax Year overview Self Assessment - Tax Calculation Name XXX 2 Tax Reference Address XXX 11111111111111111 Tax Calculation for 2016 - 17 (year ended 5 April 2017) Income received (before tax taken off) Pay from all employments £19,458.00 Profit from partnerships £2,142.00 Interest received from UK banks and building societies £50.00 Total Income received £26,526.00 minus Personal allowanc e £11,000.00 Total income on which tax is due £15476.00 How I worked out your Income Tax Pay, pensions, profit et c £10,600.00 @ 20% £2,120.00 Interest received from bank of building societ y etc. £50 @ 0% = £0.00 Dividends from companies etc. @ 0% = £0 Income Tax charged £17,086.00 minus 10% tax credits on dividends from UK companies (not repay able) £487.60 Income Tax due after dividend tax credits £2,120.00 plus Total pension savings charges (£2,985 minus tax treated as paid £0) £2,984.60 Income Tax due £5104.60 minus Tax deducted From all employments, UK pensions and state benefits -£2,003.80 Interest received from UK banks and building societies £10.00 Total tax deducted £3,100.80 Total Income Tax due £17,086.00 plus Capital Gains Tax Taxable capital gain 4 £18,000.00 £10,400.00 @ 18% £1,872.00 £7,600.00 @ 28% £2,128.00 £4,000.00 Capital Gains Tax due £4,000.00 Income and Capital Gains Tax due £7,100.80 1 of 2 01/05/2017 14:02 This is an example of a All figures used are for illustrative purposes only All figures used are for illustrative purposes only commercial software tax Without supplying all requested proofs your case can’t progress to calculation. There are several Case Assessment stage. other versions, but they must include the same information. Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print. F1062 (2FWREHU 2017) Nationwide Building Society, Nationwide House, Pipers Way, Swindon, Wiltshire, SN38 1NW. Correct at time of going to print. F1062 (October 2017)

A guide to our HMRC Tax Calculation & Tax Year Overview requirements Page 2 Page 4

A guide to our HMRC Tax Calculation & Tax Year Overview requirements Page 2 Page 4.png)